Known for its business and tax-friendly environment, South Carolina taxes are among the lowest in the nation. The state offers a variety of tax incentives, including job tax credits, property tax exemptions, and corporate income tax credits, to encourage businesses to locate and expand in the state. In addition, South Carolina has a streamlined tax system that is easy to navigate, with low administrative costs and a simple tax structure.

These and other factors have made the state an attractive destination for companies looking to start or expand their operations, particularly in manufacturing, logistics, and technology. Overall, South Carolina’s business-friendly tax policies have helped create a vibrant and growing economy that benefits businesses and residents alike.

To learn more about State and Local Incentives, download our brochure.

The Greenville County Zoning Administration is responsible for all of the zoning, rezoning, site review, appeals, and development services. To that end, GADC and GADC partners must comply with their rules on building, occupying, permitting etc.

To learn more visit, Greenville County Zoning Permitting Applications or Greenville County Zoning Administration.

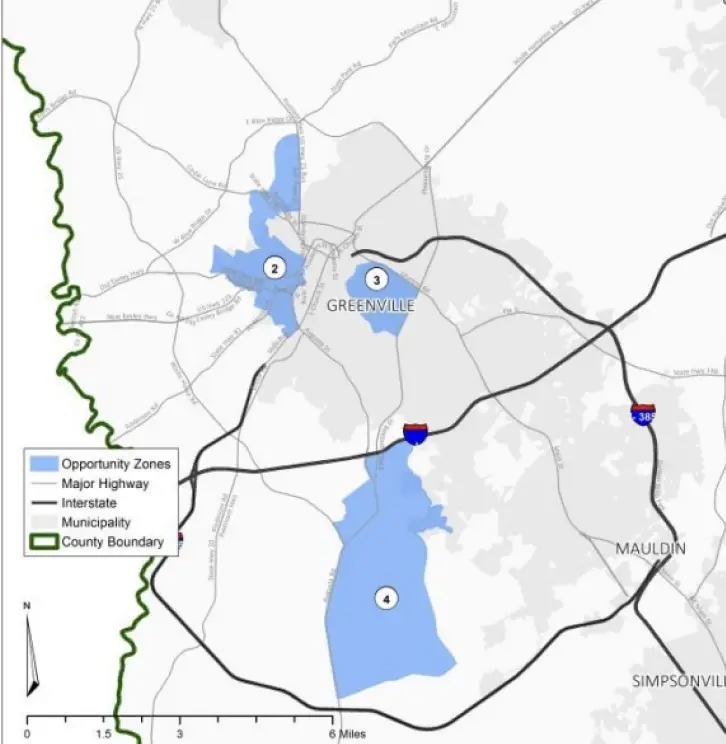

The Opportunity Zones incentive is a community development program encouraging long-term private investments in low-income communities. This program provides a federal tax incentive for taxpayers who reinvest unrealized capital gains into “Opportunity Funds,” which are specialized vehicles dedicated to investing in areas designated as “Opportunity Zones.” Nine (9) census tracts have been selected in Greenville County as Opportunity Zones.

For further details, download the GADC Opportunity Zones Flyer.

Would you like to get in touch with us? Please use the contact information below, or you can use the contact form to send us a message.

GADC’s offices are located

in downtown Greenville.

301 University Ridge

Suite N-4300

Greenville, SC 29601

View map for directions

and parking information.